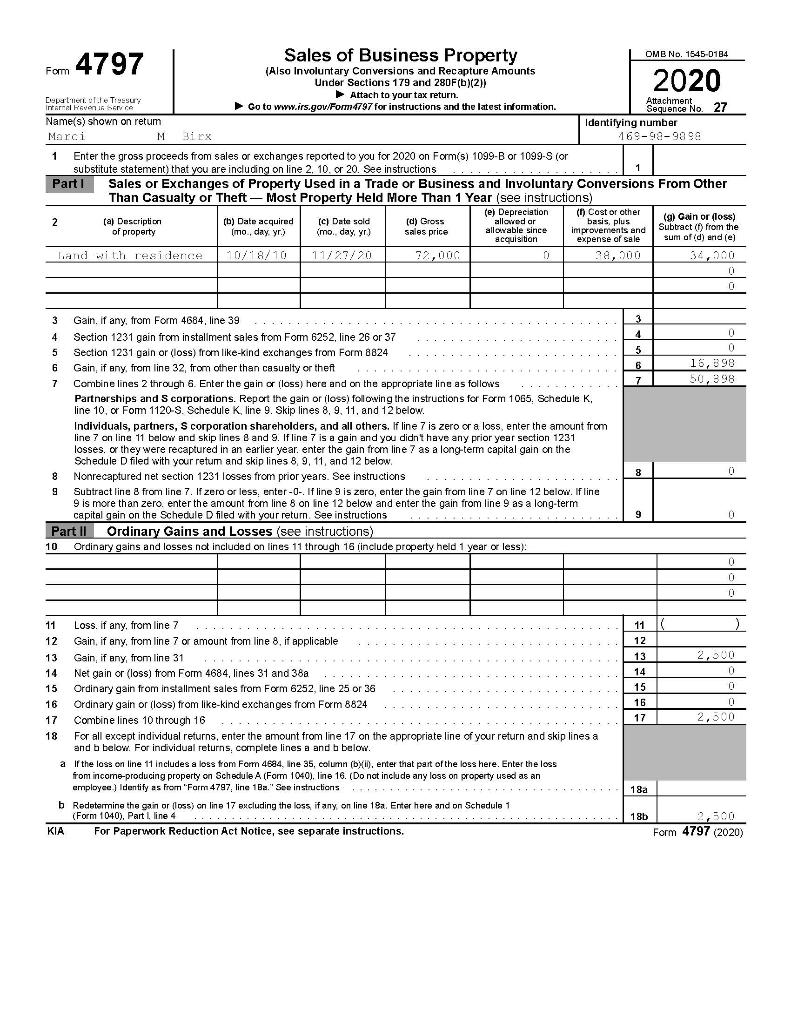

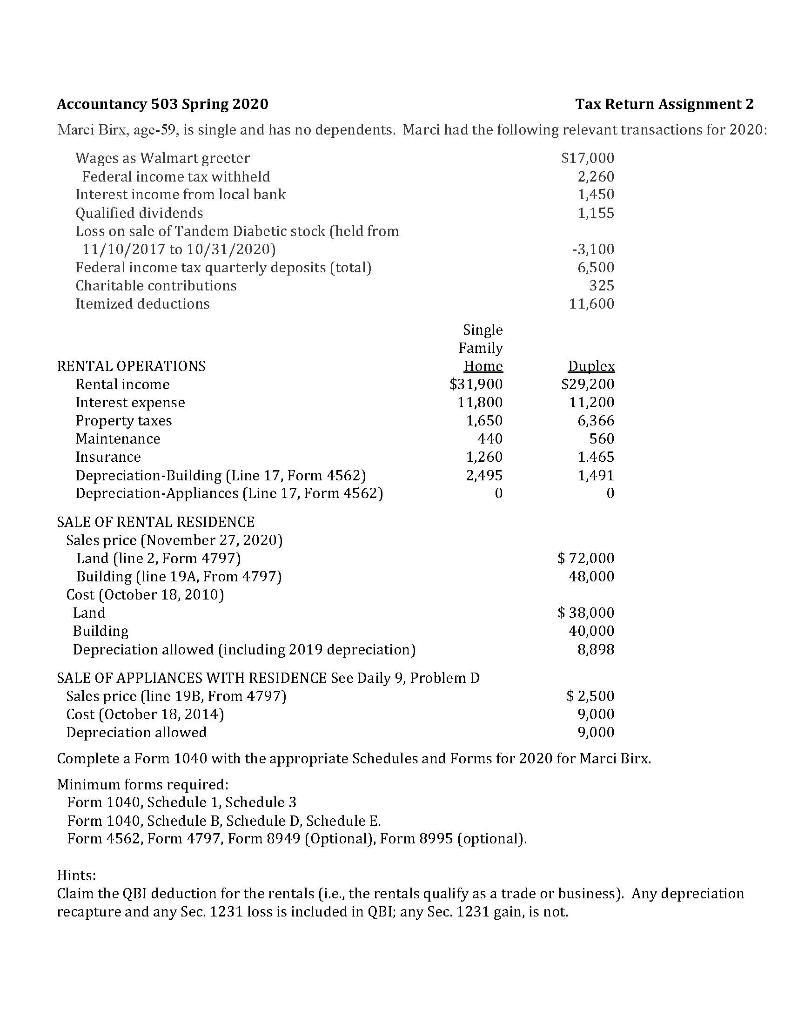

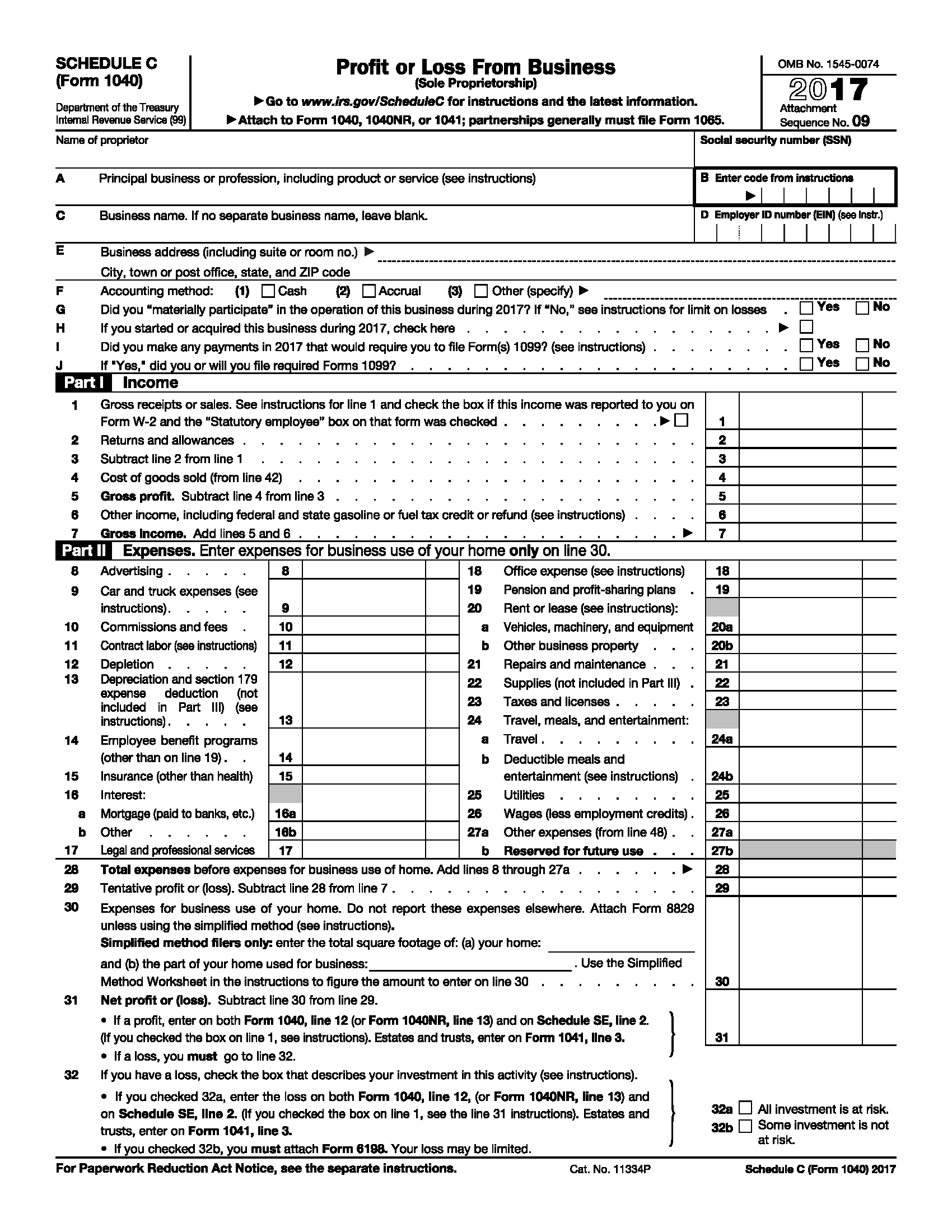

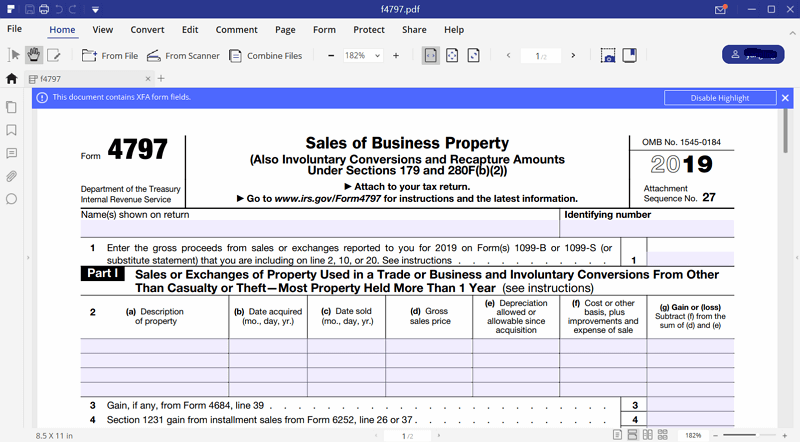

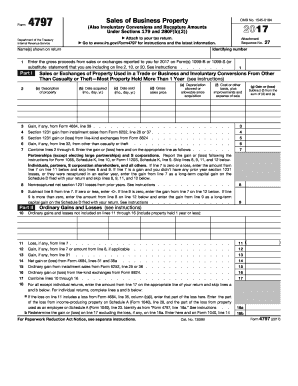

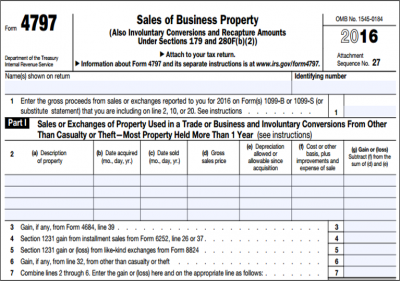

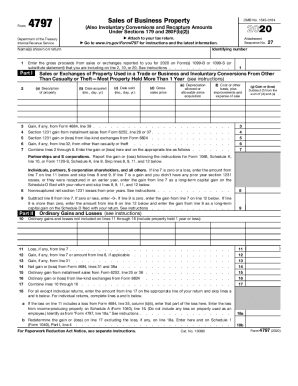

Apr 29, 18 · This is about Tax form 4797 Let me give you exact case details DB purchased a residential property at Phoenix, AZ, on for $1,000 and spent $13,900 for home improvements The adjusted cost basis therefore is $133,900 He sold this property on for $6,500 less selling expense of $13,492Generally, Form 4797 is used to report the sale of a business This may include your home that was converted into a rental property or any real property used for trade or business Who Can File Form 4797 Sales of Business Property?Apr 02, 18 · On form 4797 you will use accumulated depreciation to have ab adjusted basis You do NOT deduct depreciation on this form So that the only figures on my Sch E are rents received and the usual expenses (taxes, insurance, maintenance fees, etc)?

Line 7 Of Form 4797 Is 50 8 At What Rate S Is Chegg Com

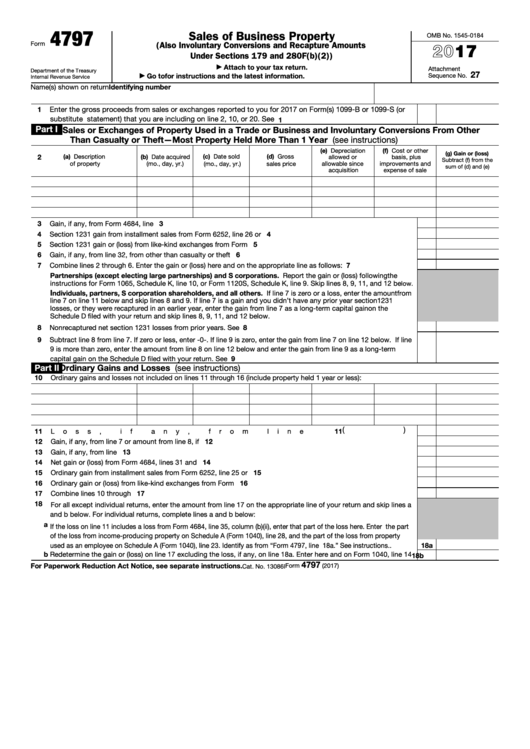

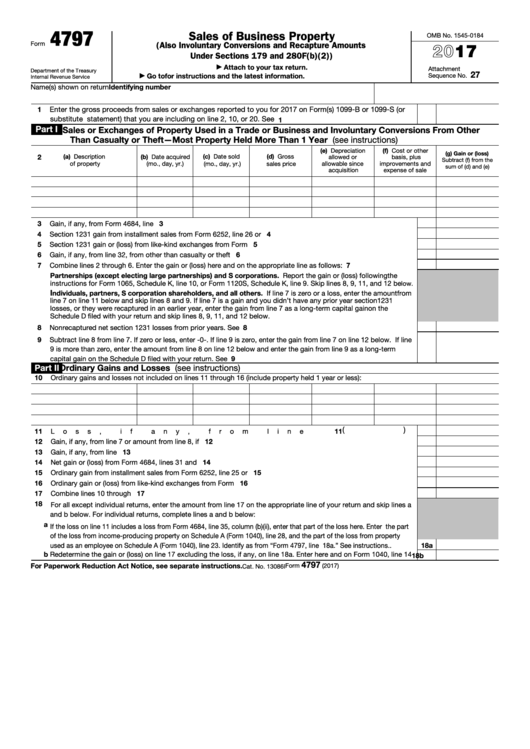

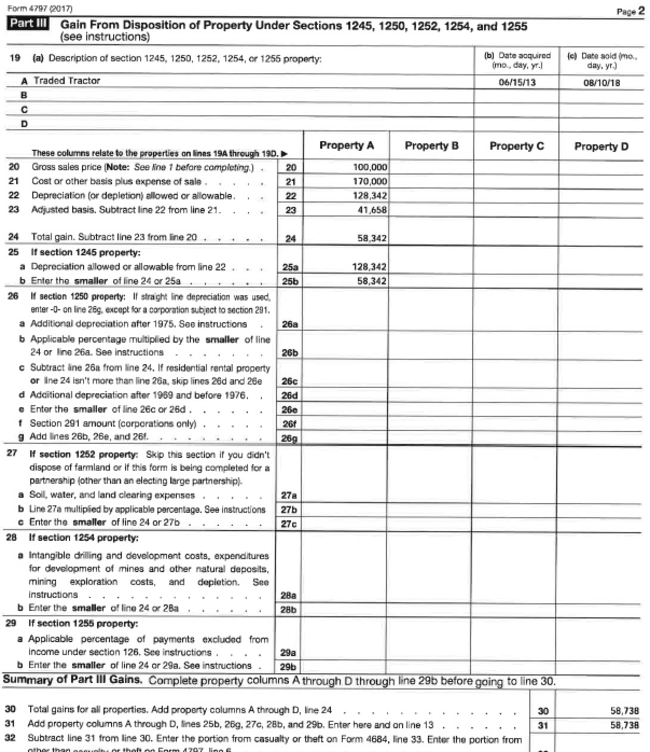

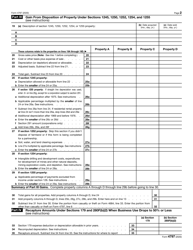

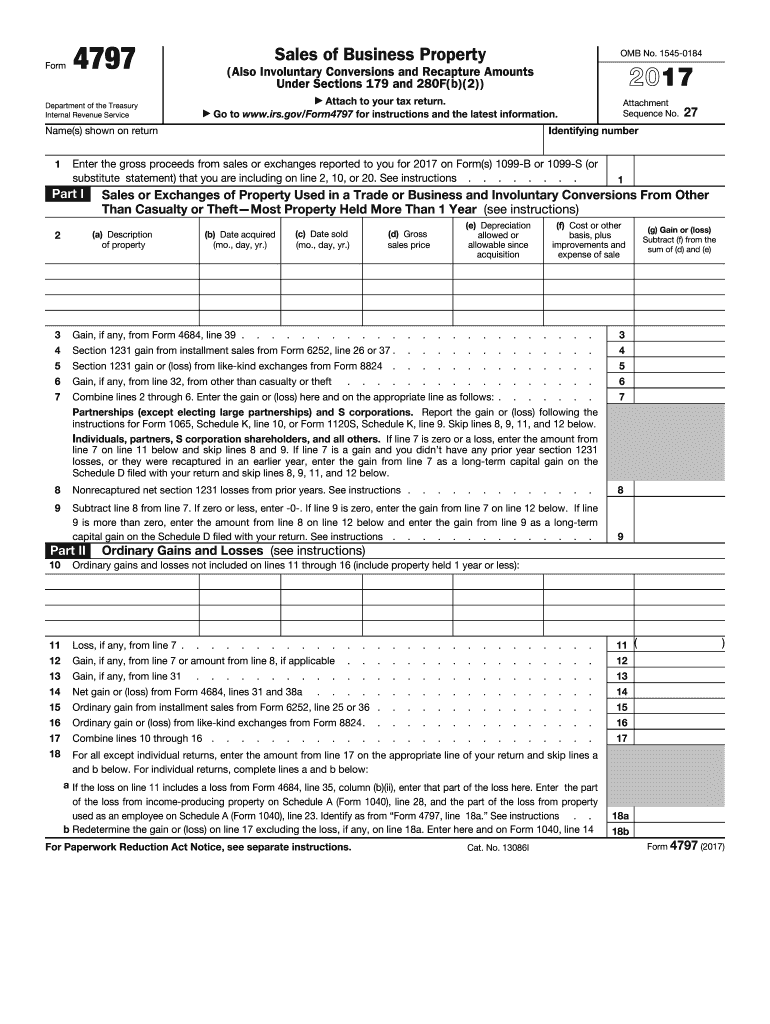

Irs form 4797 for 2017

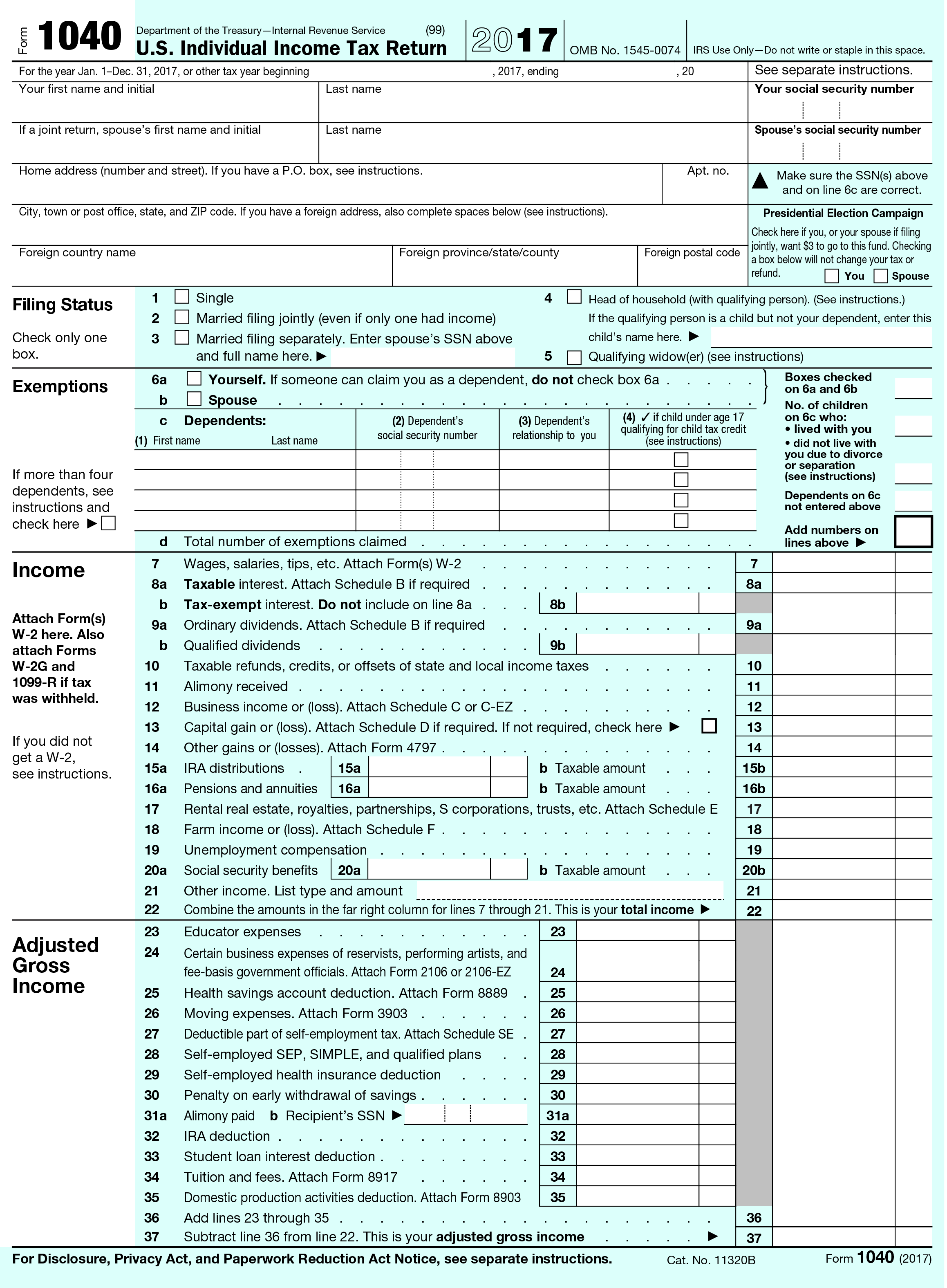

Irs form 4797 for 2017-Get And Sign Online W9 Form 1721 ;17 Individual Income Tax Forms and Instructions Underpayment of Estimated Income Tax Instructions included on form MI4797 Application for Extension of Time to File Michigan Tax Returns Instructions included on form 151 Authorized Representative Declaration/Power of

Fillable Form 4797 Sales Of Business Property 17 Printable Pdf Download

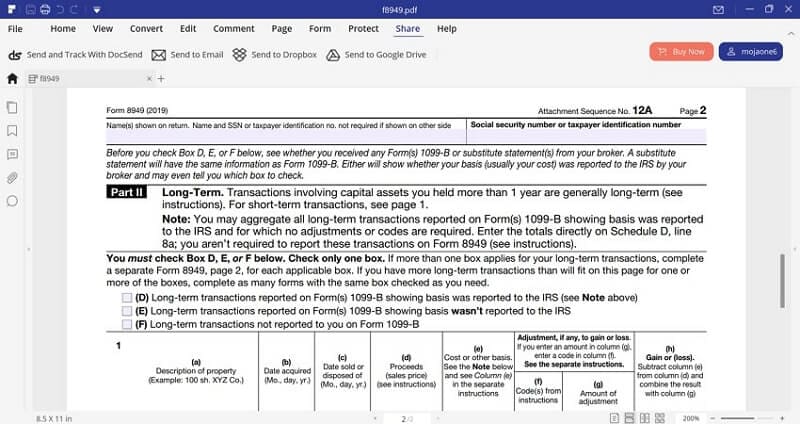

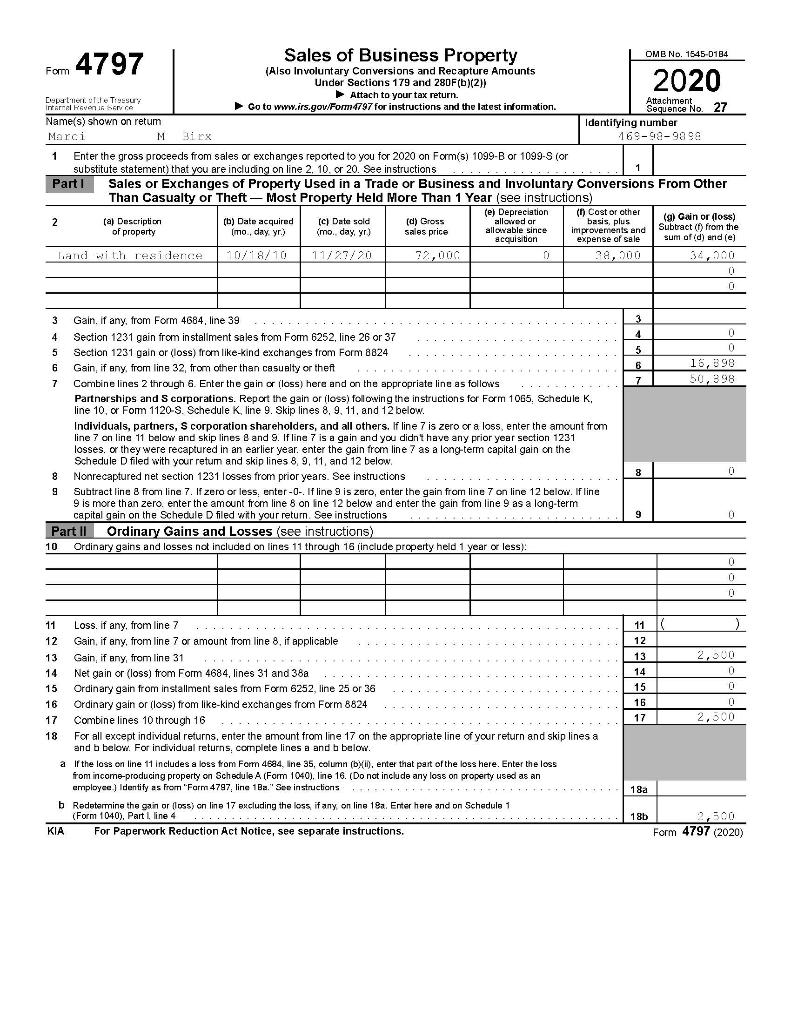

Form 4797 Sale of Rental Home and Land Depreciable and Nondepreciable If you disposed of both depreciable property and other property (for example, a building and land) in the same transaction and realized a gain, you must allocate the amount realized between the two types of property based on their respective fair market values (FMVs) toForm 4797 (Sales of Business Property) is a tax form distributed by the Internal Revenue Service (IRS) It is used to report gains made from the sale or exchange of business property, includingSep 25, 18 · Can i offset a gain on form 4797 with a non recaptured section 1231 loss from 15?

Jun 29, 18 · Put simply, IRS form 4797 is a tax form that's used specifically for reporting the gains or losses made from the sale or exchange of certain kinds of business property or assets The types of property that often show up on form 4797 include things like property used for generating rental income, as well as property that's employed as partI am trying to figure out form 4797 for a property that I sold in 17, specifically the "basis" on line 21 Sept Answered by a verified Tax Professional We use cookies to give you the best possible experience on our websiteSignNow combines ease of use, affordability and security in one online tool, all without forcing extra software on you All you need is smooth internet connection and a device to work on Follow the stepbystep instructions below to esign your 17 form 4797

May 30, 19 · Hello all, I am trying to figure out how to fill out form 4797 for the tax year 13 The duplex was purchased in 07 for $240,000 and sold in 13 for $251,900 It was used as a rental property the entire time and was never owner occupied Here are the facts Purchased in 07 for $240,000 (Land 50,000 Building 190,000) Sold in 13 forInst 4797 Instructions for Form 4797, Sales of Business Property « Previous 1 Next » Get Adobe ® ReaderForm 4797 17 for a onesizefitsall solution to esign form 4797?

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

Form 4797 Youtube

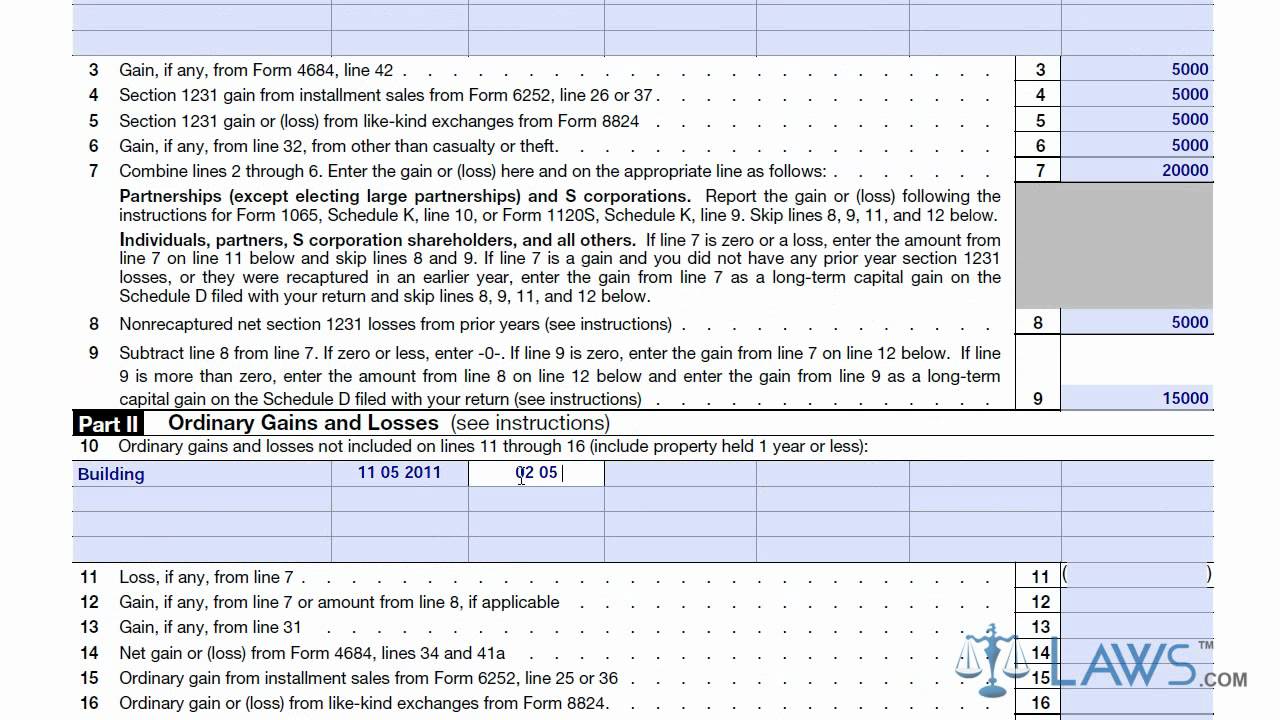

Product Number Title Revision Date;Treasury IRS Forms Get And Sign Form 1099 MISC 1721 ;G/L reported on Form 4797, Part 1 Example 31 Example 31 Form 4797 reporting Form 4797, Part II Part II is the collection point for transaction 17 4461% 4,461 5,000 Use IRS Form

Irs 11 Schedule D 21 Fill Out Tax Template Online Us Legal Forms

Lovely Irs Form 4684 For 17 Models Form Ideas

Instructions and Help about form 4797 instructions Laws dotcom legal forms guide Form is United States Internal Revenue Service tax form used to report noncash charitable contributions of over $500 made by an individual or corporate taxpayer only use this form for the donation of property not the donation of time or funds that are cash based Form can bePubl 1 Your Rights As A Taxpayer 17 Publ 1 Your Rights As A Taxpayer 14 Publ 1Jun 13, 17 · Form 4797 is often confusing due to the many kinds of property and the capital gain or ordinary treatment consequences basis issues and form preparation using live examples June 13, 17 Noon to 2 PM (CST) 2 hours of CPE is the tax specialist at ISU's Center for Agricultural Law & Taxation Prior to joining CALT, Kristy worked

Irs Form 4797 Instructions Fill Out And Sign Printable Pdf Template Signnow

Line 7 Of Form 4797 Is 50 8 At What Rate S Is Chegg Com

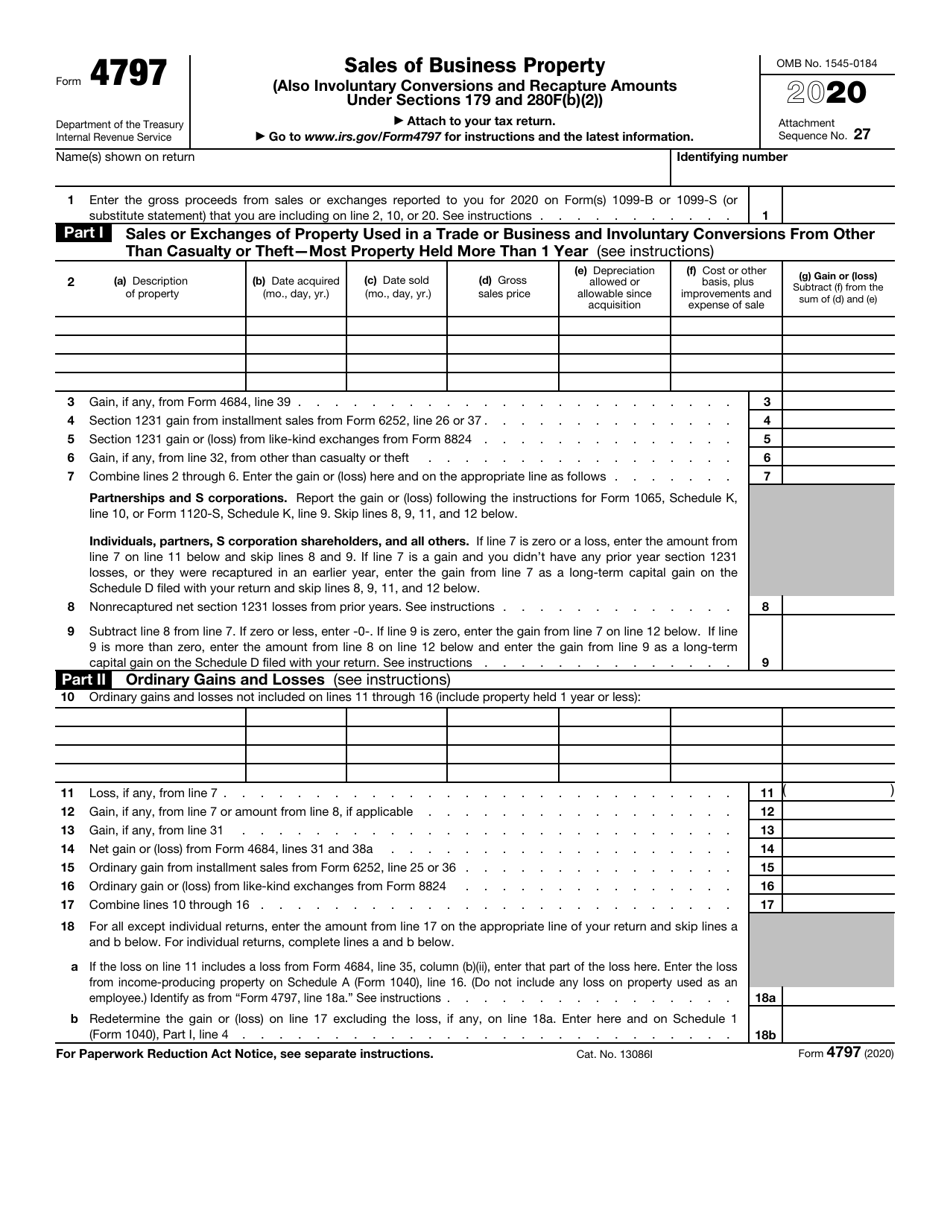

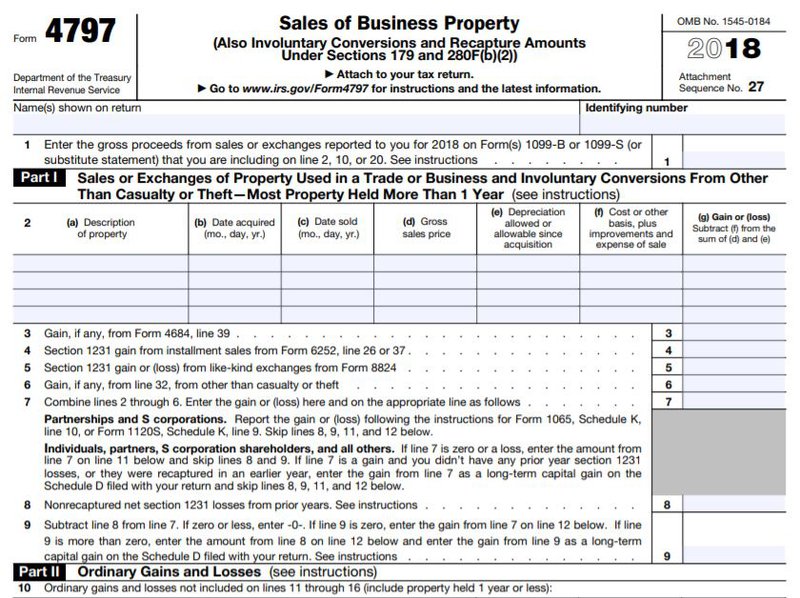

Other Form 17 considerations The halfpage Form 17 only allows you to include the payments you actually make during the tax year However, if you pay for a course that doesn't start until next year, you can still deduct those expenses as long as it starts before April 1On Form 4797, line 2, enter "Section 1397B Rollover" in column (a) and enter as a (loss) in column (g) the amount of gain included on Form 4797 that you are electing to postpone If you are reporting the sale directly on Form 4797, line 2, use the line directly below the line on which you reported the sale Preparing and sending the form toForm 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax

Irs Form 49 The Instructions To Fill It Right

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

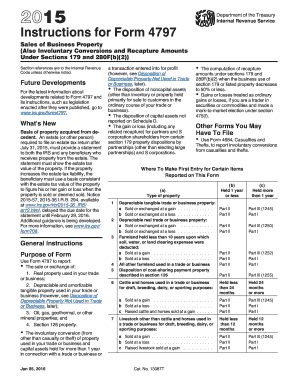

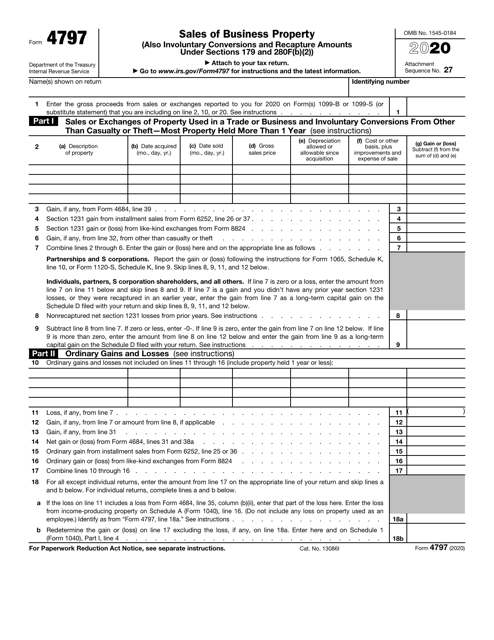

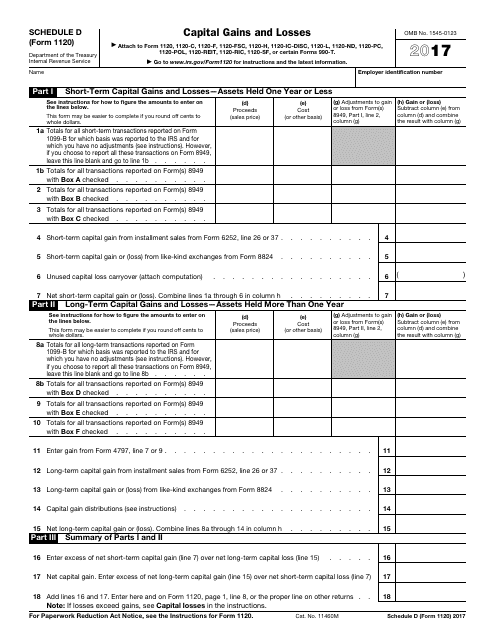

17 Instructions for Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future DevelopmentsFor many, navigating the sea of tax forms proves a difficult task If you own a business or corporation, you may have two more forms to wrestle with than the average taxpayer Both the Form 4797 and Schedule D pertain to funds acquired through the sale or liquidation of a businessIf you have not entered an asset for depreciation, the screen to enter a loss on Part II of IRS Form 4797 will not appear If you need to enter a loss on Form 4797 Part II, use the instructions below to add the necessary information

18 Tax Changes By Form Taxchanges Us

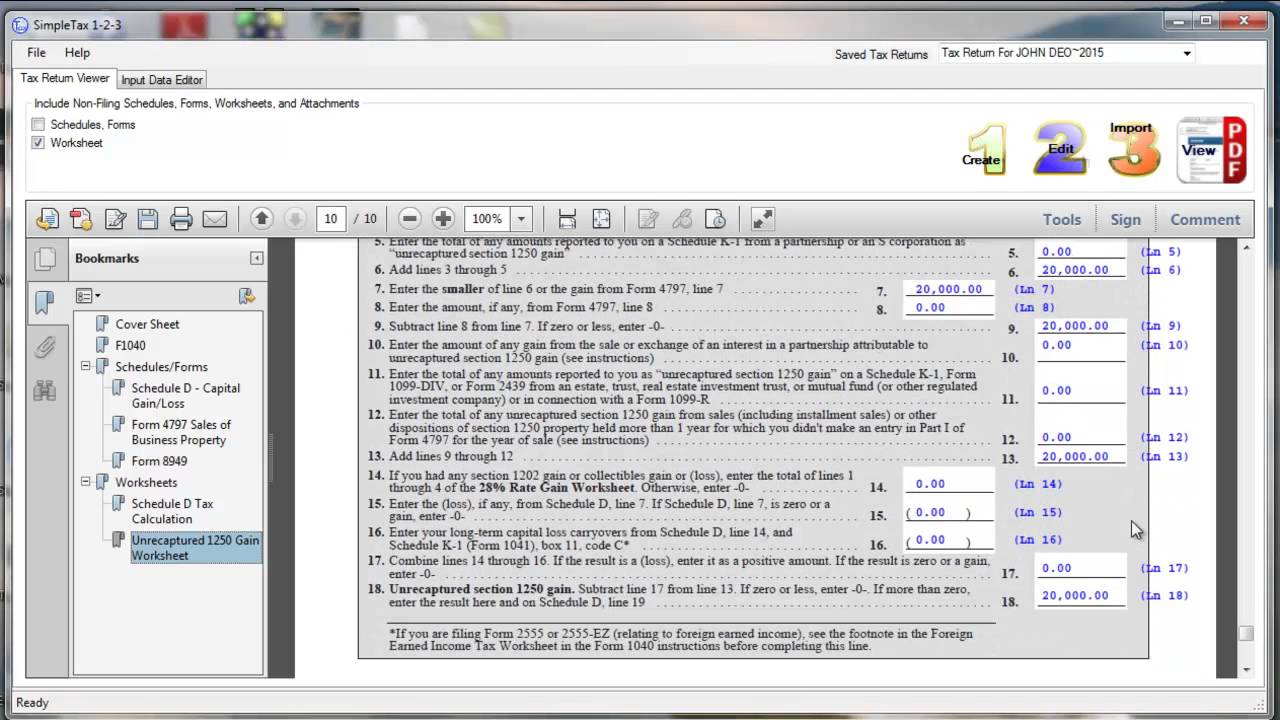

Simpletax Form 4797 Youtube

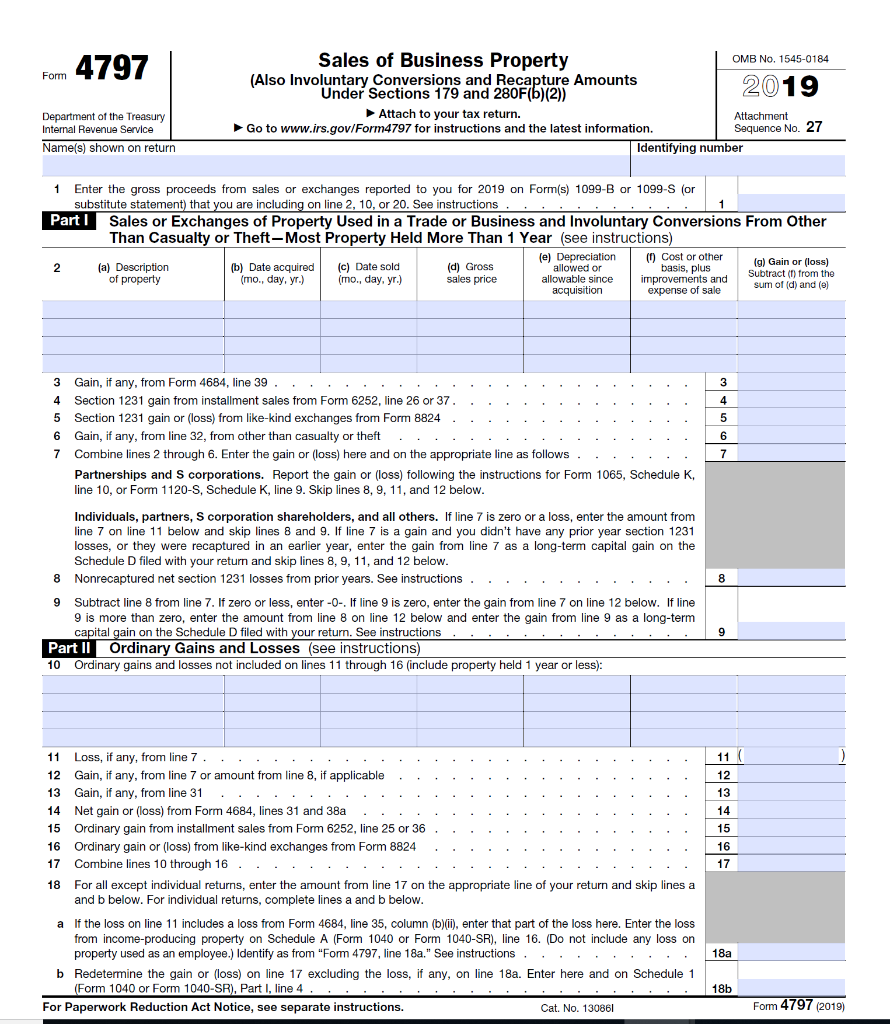

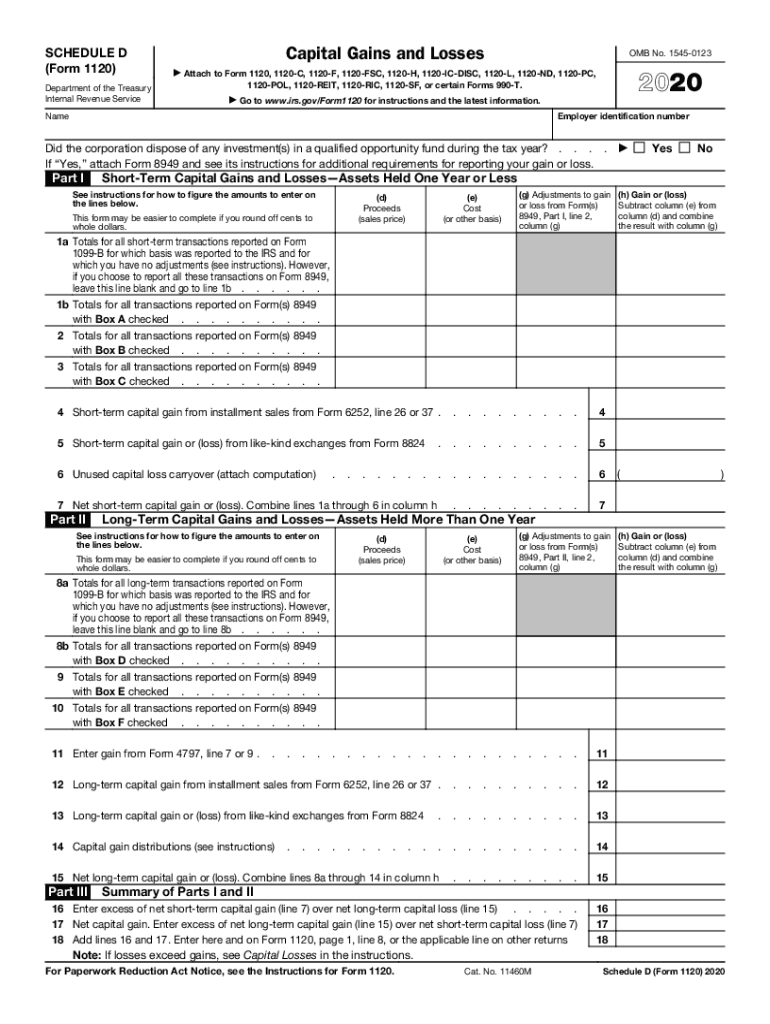

Use Form 4797 to report The sale or exchange of property The involuntary conversion of property and capital assets The disposition of noncapital assetsForm 11C Occupational Tax and Registration Return for Wagering 1217 12/21/17 Form 23 Application for Enrollment to Practice Before the Internal Revenue Service 10 09/30/ Form 56 Notice Concerning Fiduciary Relationship 1219 05// Inst 56Instructions Tips More Information Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download

Rrd Alternative Channel 16 Tax Forms

Reporting Gambling Winnings Other Income On Schedule 1 Don T Mess With Taxes

The law states that basis is reduced by depreciation allowed or allowable If you don't take depreciation, the IRS will reduce your basis when sold anyway as if you had taken depreciationForm 4797, also known as sales of business property, is an internal revenue serviceissued tax form and used to report gains made from the sale or exchange of business property business property may refer to property purchased in order to produce rental income or a home that was used as a businessOf the loss from incomeproducing property on Schedule A (Form 1040), line 28, and the part of the loss from property used as an employee on Schedule A (Form 1040), line 23 Identify as from "Form 4797, line 18a"

/GettyImages-157394060-573f646d3df78c6bb0160735.jpg)

Bonus Depreciation And How It Affects Business Taxes

Webinar Form 4797 Sale Of A Business Asset Center For Agricultural Law And Taxation

Jan 07, 21 · The IRS form 4797 is a PDF form which can be filled using a PDF form filler application The IRS form 4797 is used to report, Real property used in your trade or business, depreciable and amortizable tangible property used in your trade or business and many other similar propertiesForm 4797 Sale of Business Property Force to Part II To enter a loss for the sale of business property not entered in TaxAct® as an asset for depreciation From within your TaxAct return ( Online or Desktop), click on the Federal tabReal Estate Using IRS Form 84 17 Tax Return Edition "This publication is designed to provide accurate and authoritative on IRS Form 4797, Sales of Business Property, Schedule D (IRS Form 1040), Capital Gains and Losses, and/or IRS Form 6252, Installment Sale Income See paragraph 6

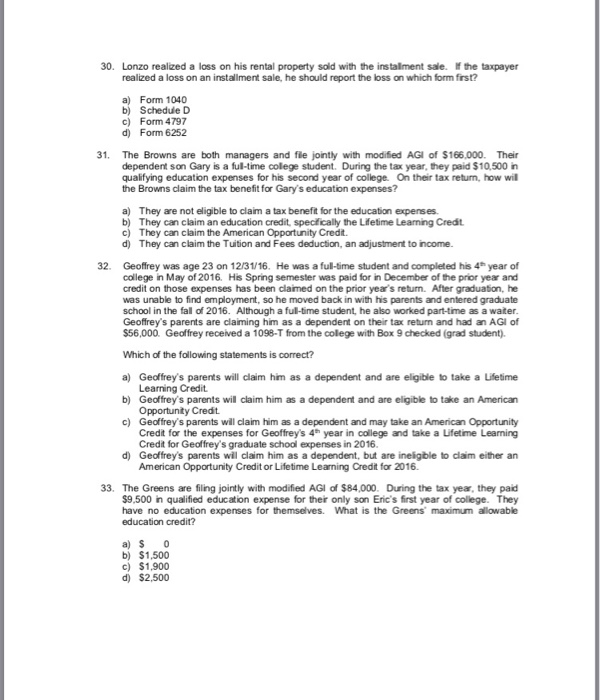

Tax Forms Irs Tax Forms Bankrate Com

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

The Purpose Of Irs Form 49

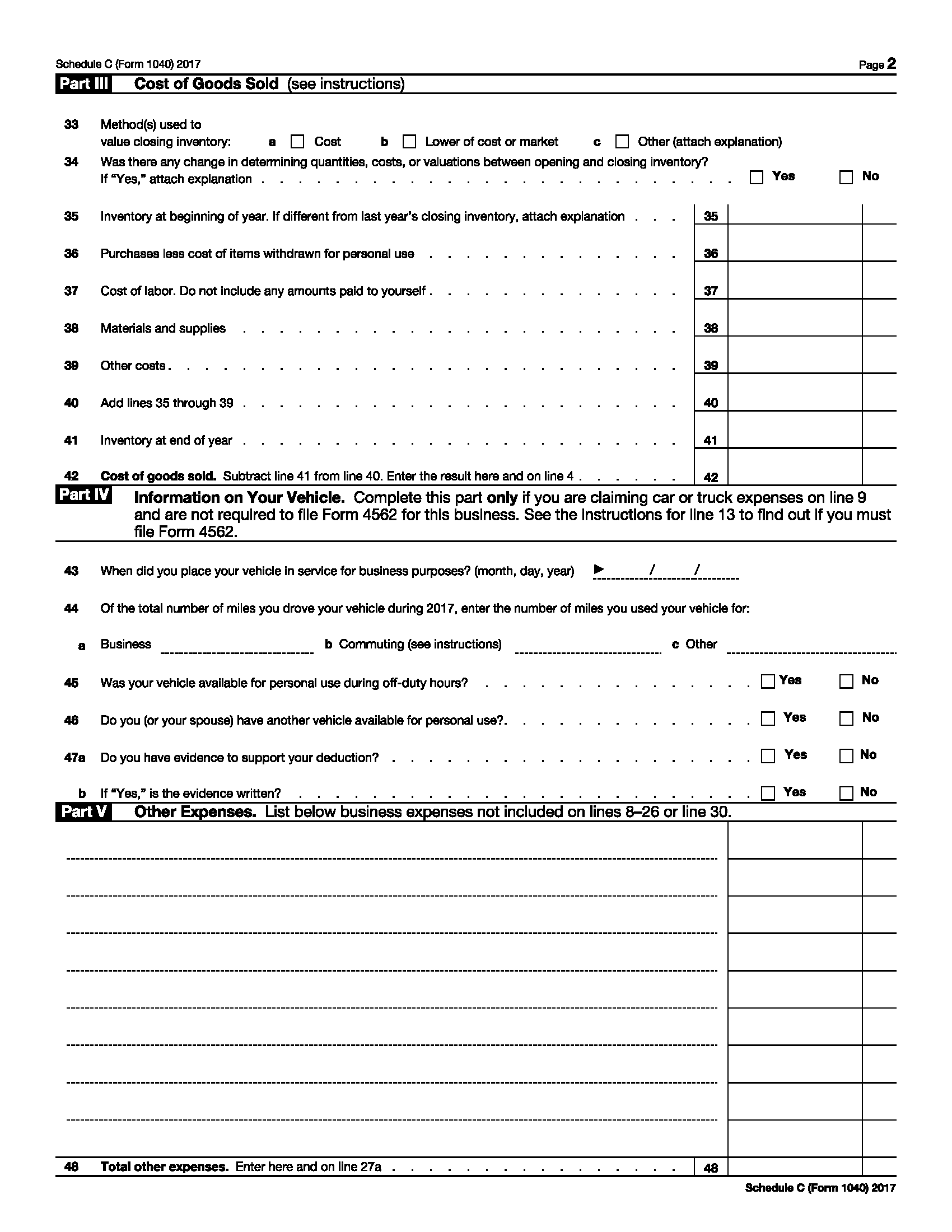

Jun 06, 19 · When filling out form 4797 for the sale of rental property, what go into line 2?Both were sales of rental property Answered by a verified Tax Professional We use cookies to give you the best possible experience on our websiteOn Form 4797, Part I The sales price is $135,000 ($15,000 x 9 acres) His basis deduction is Sold for $138,000 in 17 $28K land, $110K for building Belle Pepper's 4797 Continued income on IRS Form 6252 If property is a business asset, sale also reported on Form 4797

Tax Forms Irs Tax Forms Bankrate Com

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

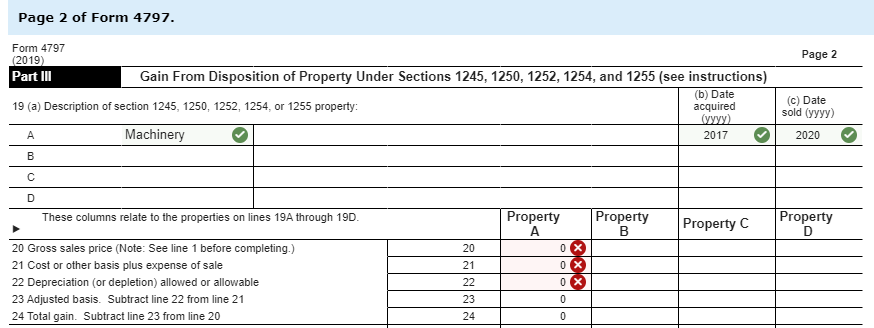

17 TAX INSTRUCTION BOOKLET DOWNLOAD YOUR TAX INFORMATION FROM THE CEDAR FAIR INVESTOR RELATIONS WEBSITE IRCEDARFAIRCOM Box 5 Interest Income GF6A column (g), of Form 4797, Sales of Business Property Do not complete columns (b) through (f) on line 2 of Form 4797 Instead, write "From Schedule K1 (Form6/13/17 3 Center for Agricultural Law & Taxation Form 4797 Purpose of Form • The computation of recapture amounts under §§ 179 and 280F(b)(2) when the business use of § 179 or listed property decreases to 50% or lessThe four sections of Form 4797 are reviewed along with a discussion of how the results are reported on Form 1040 This course covers the proper use of Form 4797, Sales of Business Property Understand the tax treatment of gain from §1245 recapture, §179 recapture, §1250 unrecaptured gain, and §1231 gain In 17, Kevin was awarded

How To Fill Out Form 4797 Rental Property Property Walls

Question Based On A Through C Complete Murph Chegg Com

Get And Sign 1096 Online Form 1721This is an example of using Form 4797 for sales of rental propertyGet And Sign IRS W 2 Form 1721 ;

Line 7 Of Form 4797 Is 50 8 At What Rate S Is Chegg Com

How To Report The Sale Of A U S Rental Property Madan Ca

Mar 01, 17 · Form 4797 generally reports the sale of assets utilized in a trade or business as described in IRC §1231 Preparers should be aware that §1231 provisions are applicable to a wide range of parties, including but not limited to individuals, corporations, partnerships, trusts,If you file US Schedule D or Form 4797 and you elect to adjust under Section 271 of the Michigan Income Tax Act, you must file the equivalent Michigan forms (MI1040D or MI4797) You must include all items of gain or loss realized during the tax yearThe Internal Revenue Service usually releases income tax forms for the current tax year between October and January, although changes to some forms can come even later We last updated Federal Form 4797 from the Internal Revenue Service in January 21

Fillable Form 4797 Sales Of Business Property 17 Printable Pdf Download

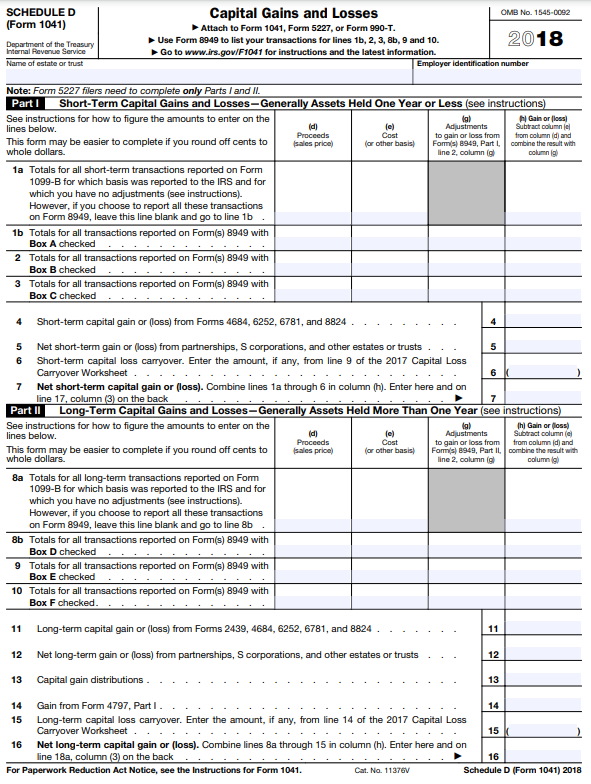

Basic Schedule D Instructions H R Block

Feb 08, 18 · Form 4797 Example Fill out, securely sign, print or email your irs form 4797 10 instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!

Fill Free Fillable Irs Pdf Forms

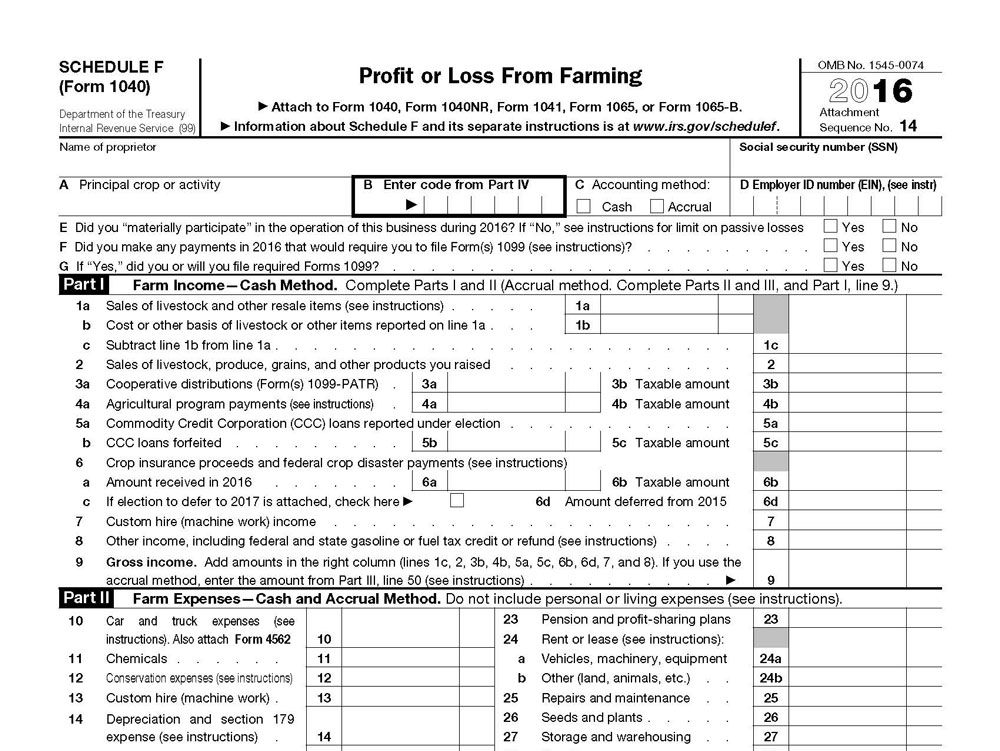

Register Now For Cooperative Extension S Tax Workshops For Farmers Nc State Extension

Does The Irs Allow A P O Box Address Amy Northard Cpa The Accountant For Creatives

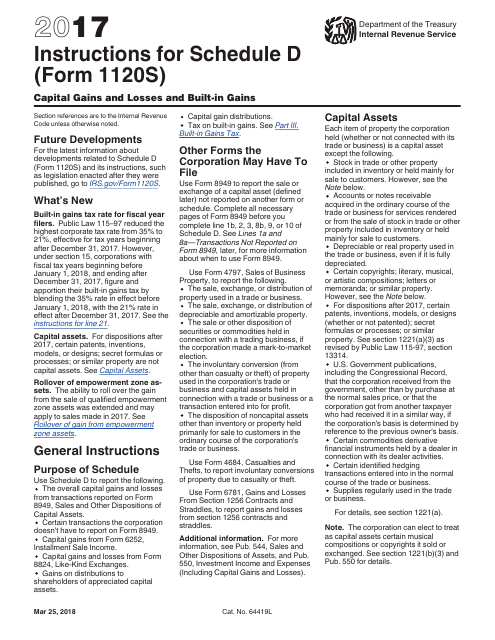

Download Instructions For Irs Form 11s Schedule D Capital Gains And Losses And Built In Gains Pdf 17 Templateroller

18 Tax Changes By Form Taxchanges Us

18 Tax Changes By Form Taxchanges Us

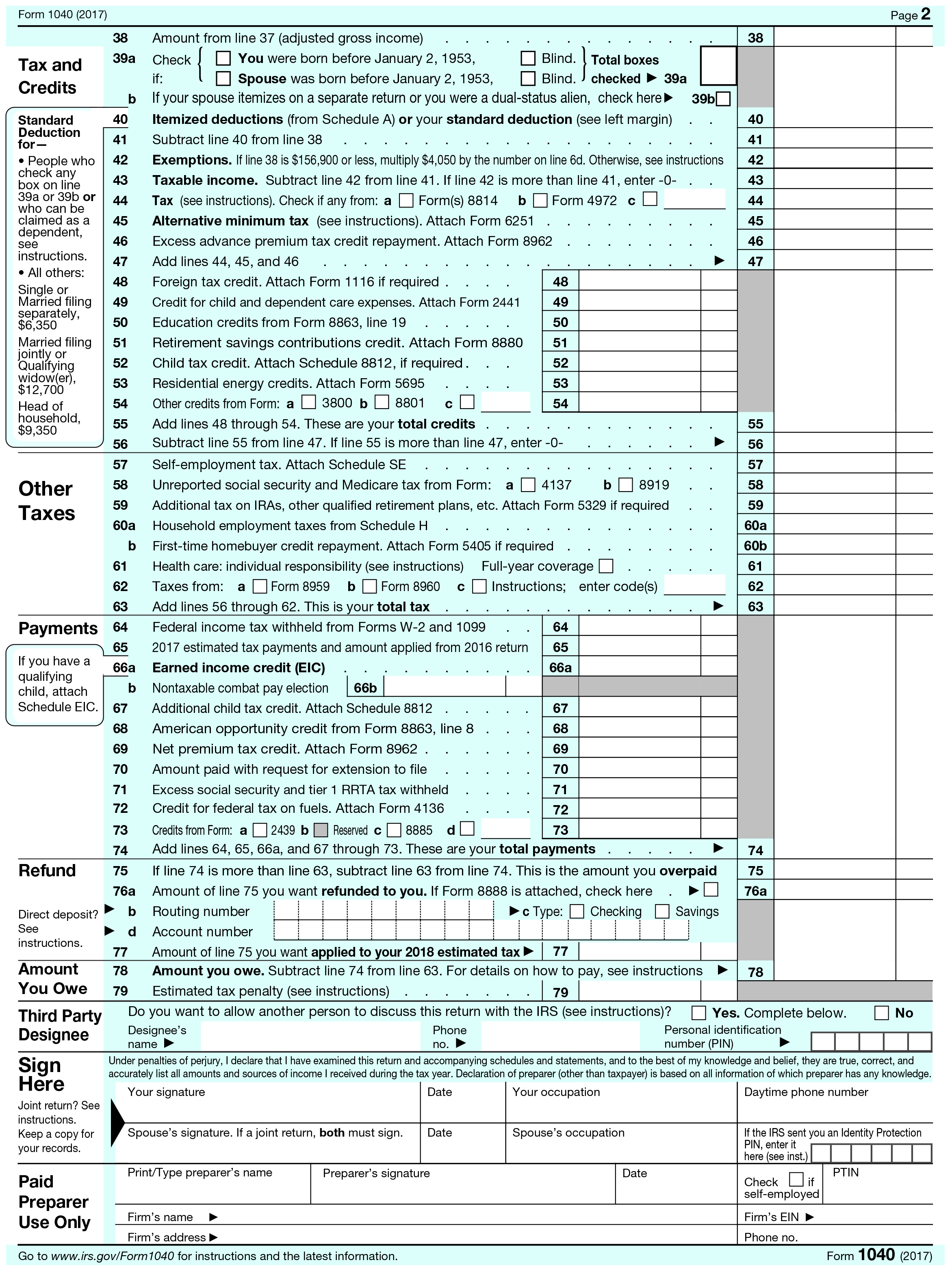

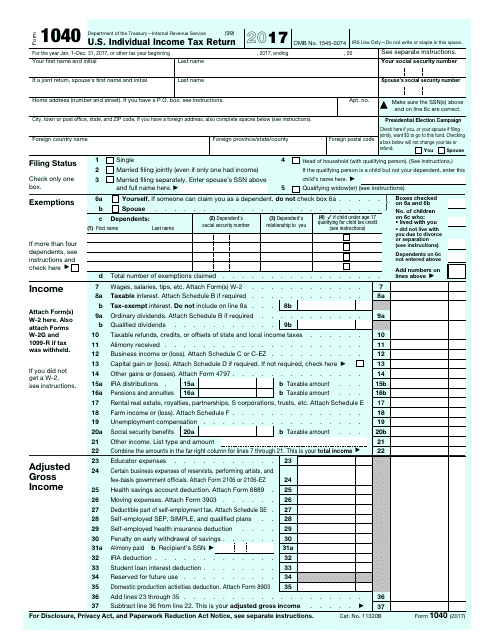

17 Form 1040 Fill Out And Sign Printable Pdf Template Signnow

Fill Free Fillable F4797 Accessible 19 Form 4797 Pdf Form

Irs 1041 Schedule D Instructions

How To Fill Out Form 4797 Rental Property Property Walls

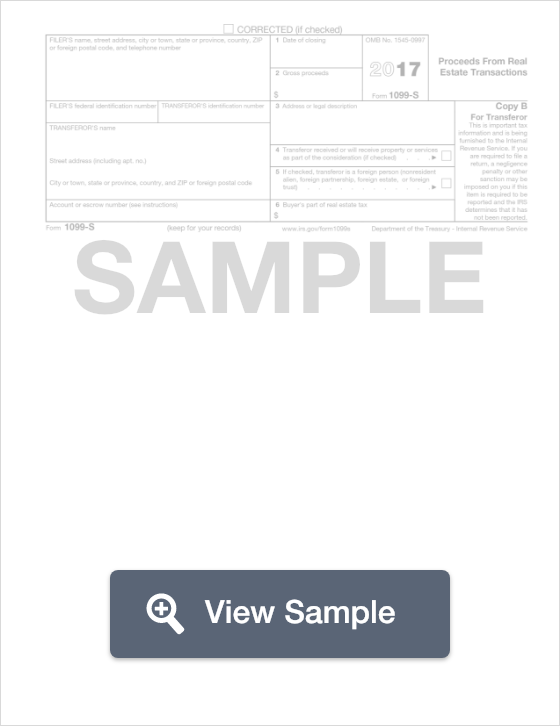

Irs Form 1099 S Real Estate Transactions Your Taxes Formswift

17 Form Irs 4797 Fill Online Printable Fillable Blank Pdffiller

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

4562 Listed Property Type 4562

18 Tax Changes By Form Taxchanges Us

From Above View Of 17 Irs Form 1040 On Wooden Desk License Download Or Print For 6 50 Photos Picfair

Opportunity Zones Tax Returns How To

Edwardsfranklandcarolj 17 Pages 1 50 Flip Pdf Download Fliphtml5

Form 4797 Sale Of Assets The Good The Bad And The Ugly

17 Form Irs 4797 Fill Online Printable Fillable Blank Pdffiller

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Producer Impacts From The Tax Cuts And Jobs Act Umn Extension

Department Of The Treasury Internal Revenue Service 99 1040 U S Individual Income Tax Return 17 Omb No 1545 0074 Irs Use Only Do Not Write Or Staple In This Space For The Year Jan 1 Dec 31 17 Or Other Tax Year Beginning 17 Ending

Form Irs Instruction 4797 Fill Online Printable Fillable Blank Pdffiller

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Solved Required Information The Following Information Ap Chegg Com

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Global Brigades Usa Form 990 T 17 Public Disclosure By Global Brigades Issuu

/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

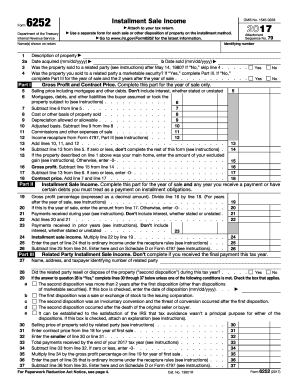

Form 6252 Installment Sale Income Definition

How To Report The Sale Of A U S Rental Property Madan Ca

Elegant Irs Form 1040 V 17 Models Form Ideas

Schedule D For Cryptocurrency Gains The Cryptocurrency Forums

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Opinion Filing Taxes In Japan Is A Breeze Why Not Here The New York Times

17 Form Irs 4797 Fill Online Printable Fillable Blank Pdffiller

/GettyImages-932243540-5be86396c9e77c0051d2c714.jpg)

Business Related Ordinary Gains On Your Tax Return

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

F I L L A B L E I R S F O R M 1 1 2 0 S 2 0 1 7 Zonealarm Results

Irs 4797 Form Pdffiller

Webinar Form 4797 Sale Of A Business Asset Center For Agricultural Law And Taxation

Form 4797 Group Project Group 3 Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property Omb No 1545 0184 14 Also Course Hero

Schedule D Capital Loss Carryover Scheduled

Irs Form 1040 Download Fillable Pdf Or Fill Online U S Individual Income Tax Return 17 Templateroller

4684 Data Entry